PTPL 105: Plain Text Budgeting Progress - Paper Made My Markdown Tables Better

Plus how to move multiple iPhone app icons between screens

This week: Using paper for finance tracking has been invaluable for helping me understand the process, shaping my Markdown budget trackers into a text-based, hands-on envelope budgeting approach. Simple calculations mean I can take charge of my incomings and outgoings without a standard spreadsheet.

No AI input; all words 100% human made. Non-subscribers are welcome to read for free.

iPhone screen organising tip

You may already know how to move a bunch of iPhone app icons from one screen to another in one move, but until this week, I didn’t. It’s a trick that would have saved me a lot (a LOT) of time and frustration in times past!

Long press on an app until it jiggles

With your finger on one of the apps you want to move, tap the other apps you want to move and they’ll stack themselves in line with the one you’re holding. You can then drag the stack to its new location.

So simple!

Plain text budgeting — paper and Markdown tables both have their place

Last year I wrote about wanting to get into plain text accounting (PTA). Since then I’ve been on a journey of giving up on traditional PTA in favour of simple budgeting with Markdown tables, then ditching those for a fully paper-based system.

Well, things have changed, or should I say, progressed, once again! Markdown tables are once again the main driver, with paper a transitory aid. This is a wonderful thing because the process itself prompted the change, not system-envy or shiny object syndrome.

No doubt I over-complicated things the first time I set up my Markdown tables for the envelope budgeting system.

After spending four months solely using paper I was able to understand the process better, and see how to adapt it to my circumstances. No more copying someone else’s method verbatim; I’ve gathered the elements that work for me and left the rest. It feels great!

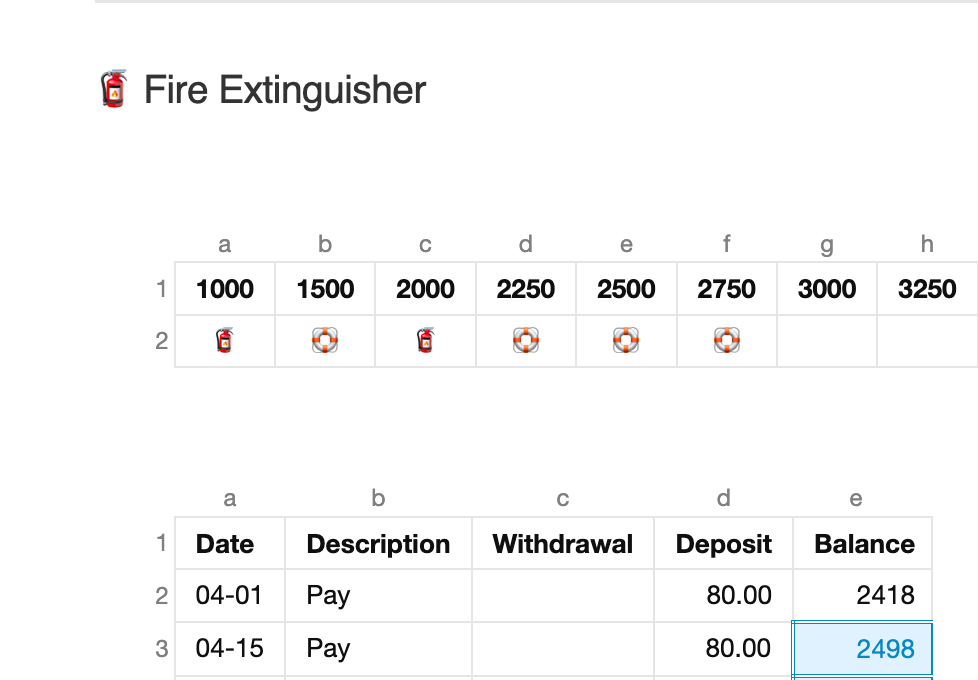

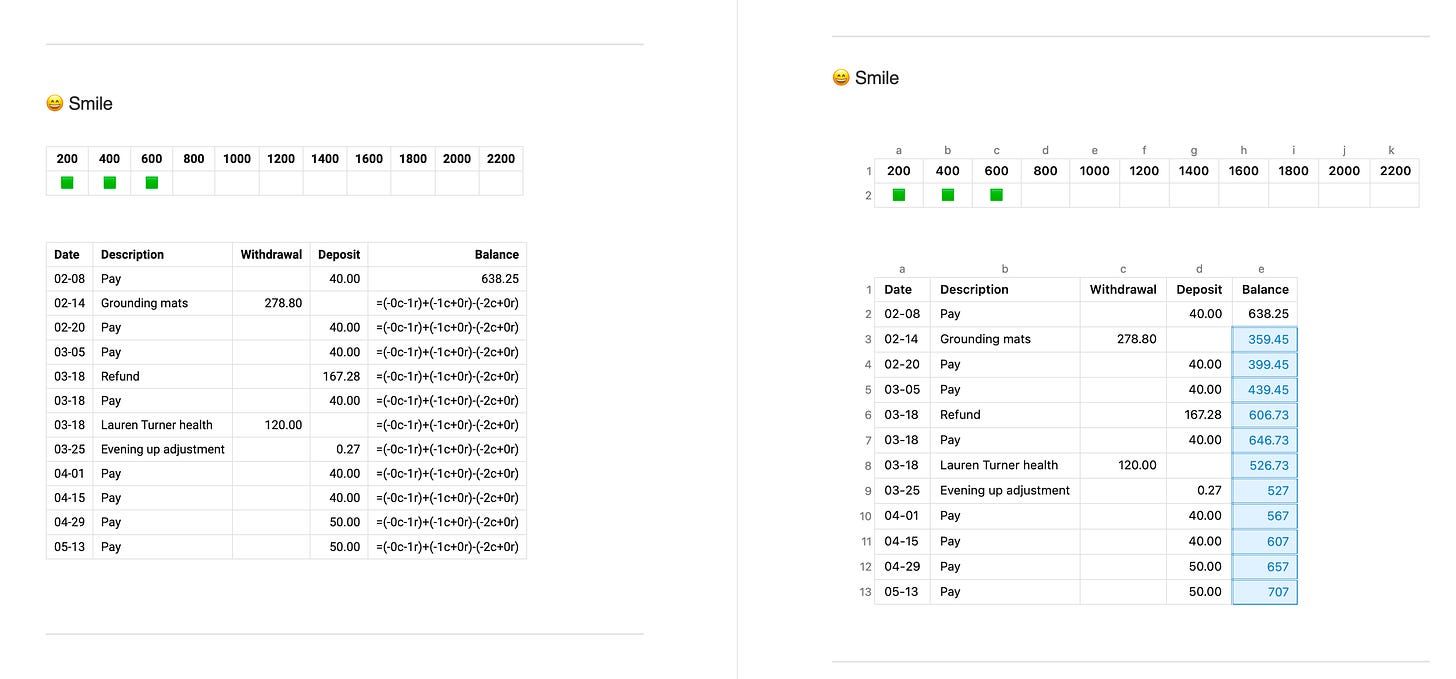

The purpose of my process is to give insights on spending patterns, and to help me save up for both needs and wants. It looks like this:

For each bank account, write down and categorise every transaction onto paper; categorise, highlight (one colour per category) and analyse actual spending vs budgeted amounts at the end of each month

Keep track of bills and sinking funds in Markdown tables (money planned and money spent, not bill reminders — those go into my calendar as repeating events)

Write out a pay check budget at least 1 week before being paid, assigning a job to every dollar

The CalcCraft plugin in Obsidian does simple table calculations for me as a non-vital convenience. Here are the formulas I use:

=(-0c-1r)+(-1c+0r)-(-2c+0r)- (formula in right most column) Calculates account balance after adding deposits/subtracting withdrawals.=(-1c+0r)+(-2c+0r)- (formula in right most column) Adds budgeted amount to current balance to show new total for sinking funds=sum(b2:b21)- Calculate the total of a column of figures

Edited to add the column sum I prefer:

=sum(+0c2:+0c-1r)- Calculate the total of a column of figures from the second row above the current cell, to the cell immediately above it

I’ll be interested to see how things are going after a few months with this approach.

I love hearing from readers, and I’m always looking for feedback. Why do you read Plain Text. Paper, Less? Is there anything you’d like to see more, or less of? Which aspects do you enjoy the most? Found a typo? Let me know in the comments, on Mastodon, or hit reply if you received this as an email.

No AI input: all words 100% human made. Download productivity goodies (including a soon-to-be-released updated Obsidian Planner demo vault) here.